are raffle tickets tax deductible irs

Buying a ticket lets you help your community but it doesnt help you claim a deduction for a charitable donation. Dear Tax Talk A nonprofit lets call it X has a raffle with 125 tickets and a 5000 first prize.

Gambling And Taxes What You Should Know 800 Gambler 800gambler Org

Learn More at AARP.

. Raffle Tickets even for a charity are not tax-deductible. Learn More at AARP. Withholding Tax on Raffle Prizes.

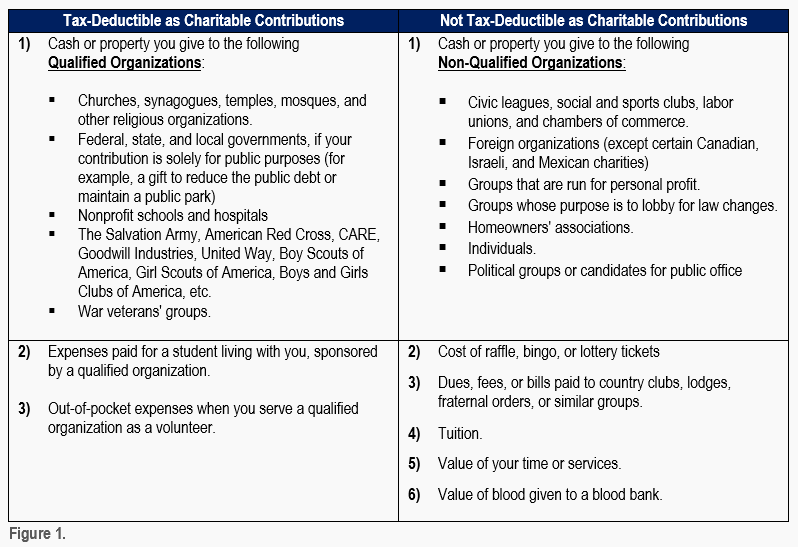

You cannot deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance. 6 Often Overlooked Tax Breaks You Dont Want to Miss. The IRS doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses.

Ad Deductions Checklist More Fillable Forms Register and Subscribe Now. Any prize that is worth 600 or more should be reported but only if the payout is at least 300 times the cost of the bet. In other words according to the IRS if you bought a 1 raffle ticket.

As I understand the taxes the first prize win is much less than the 300. The irs doesnt allow. Ad Easy Software To Help You Find All the Tax Deductions You Deserve.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Funds that are donated in exchange for benefits such as raffle tickets gala dinners or prizes however genuine are not tax deductible. Internal Revenue Service wwwirsgov Notice 1340 March 2005.

Does the winner of a raffle have taxable income. In Kind Donations And Tax Deductions 101 Donationmatch Donationmatch Are Raffle Tickets Tax Deductible. For example if you bought 100 worth of raffle tickets that did not win but won 500 on a 5 raffle ticket you would have to claim 500 in income but could deduct the 100 you spent on.

Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. Cash contributions if you dont itemize de- ductions. Are raffle tickets tax deductible irs Tuesday May 31 2022 Edit.

Any donation that meets this. Websites like Zacks provided some of the most clarity on how the IRS treats charity raffle tickets. So can I deduct the money for the tickets as a.

For information on how to report gambling winnings. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

PdfFiller allows users to edit sign fill and share their all type of documents online. I did not win the item or anything. Lou purchased a 1 ticket for a raf fle conducted by.

It is liable for the tax. PdfFiller allows users to edit sign fill and share their all type of documents online. The IRS explicitly prohibits deducting the cost of raffle tickets as a charitable contribution presumably because it does not consider the cost of the ticket to be greater than its benefit.

Ad Easy Software To Help You Find All the Tax Deductions You Deserve. If you dont itemize your deductions on Schedule A Form 1040 you may qualify to take a deduction for contributions of up to 600. The fair market value of the prize will be treated as ordinary income to the winner for federal and state income tax purposes.

Ad Deductions Checklist More Fillable Forms Register and Subscribe Now. I bought raffle tickets from a nonprofit organization for a chance to win an item. Because of the possibility of winning a prize the cost of raffle tickets you purchase at the event arent treated the same way by the IRS and are never deductible as a.

The IRS classes money spent on raffles and lotteries as contributions. Thats because you are not actually making a charitable donation but are. Must be made to a dgr However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has deductible gift recipient status.

Complete Guide To Donation Receipts For Nonprofits

Are Nonprofit Raffle Ticket Donations Tax Deductible

Are Raffle Tickets Tax Deductible The Finances Hub

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Hannah S Treasure Chest Fundraising Letter Donation Letter Fundraising Letter Fundraiser Help

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Are Raffle Tickets Tax Deductible The Finances Hub

Get Our Printable Tax Deductible Donation Receipt Template Receipt Template Receipt Tax Deductions

Are Charity Auction Items Tax Deductible Travelpledge News

Download The Request For Donation Letter Template From Vertex42 Com Donation Letter Template Donation Letter Donation Request Letters

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Are Charity Donations Tax Deductible A Tax Guide For Giving Picnic S Blog

Are Raffle Tickets Tax Deductible The Finances Hub

Are Nonprofit Raffle Ticket Donations Tax Deductible

Are Raffle Tickets Tax Deductible The Finances Hub

Are Raffle Tickets Tax Deductible The Finances Hub

An Outline Of Donation Receipts And The Tax Deduction Process Cascade Business News